- Mon - Sat: 8.00 - 18.00

- Gongoni, Magarini

- 0732870686 or 0732953605

Asset Loan

- Home

- Our Services

- Asset Loan

Leveraging Asset Loans for Household Purchases

In today’s fast-paced world, access to essential household items is not just a matter of convenience but often a necessity for maintaining a decent standard of living. However, many individuals and families face financial constraints that can make purchasing these items outright a significant challenge.

In such situations, asset loans offered by microfinance institutions can provide a lifeline, enabling individuals to acquire essential household goods without the burden of upfront costs. Let’s delve deeper into the concept of asset loans for household items and how they can benefit those in need.

We are Always Ready to Assist Our Clients

developing financial processes and procedures

Understanding Asset Loans:

Asset loans are a form of financing where borrowers pledge a valuable asset, such as jewelry, electronics, or vehicles, as collateral in exchange for a loan. Unlike traditional bank loans, asset loans typically do not require extensive credit checks or a lengthy approval process. Instead, the value of the asset serves as security for the loan, reducing the lender’s risk and enabling them to extend credit to individuals who may have limited access to formal financial services.

Benefits of Asset Loans for Household Purchases:

- Access to Essential Items: Asset loans enable individuals to acquire essential household items without having to save up for extended periods or resort to high-interest credit options. This access can improve their quality of life by providing amenities such as refrigerators, washing machines, or cooking stoves, which contribute to overall well-being and productivity.

- Flexible Repayment Options: We often offer flexible repayment terms tailored to borrowers' income levels and cash flow patterns. This flexibility reduces the likelihood of default and ensures that borrowers can repay the loan without undue financial strain.

- No Need for Perfect Credit: Asset-based lending focuses on the value of the collateral rather than the borrower's credit history. As a result, individuals with limited or poor credit scores can still qualify for loans, opening up opportunities for financial inclusion and empowerment.

- Building Creditworthiness: Successfully repaying an asset loan can help borrowers establish or improve their creditworthiness over time. This can pave the way for accessing larger loans in the future, facilitating further economic empowerment and stability.

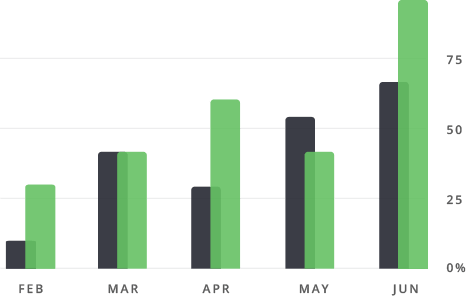

- Multiplier Effect: We often employ a multiplier effect, allowing borrowers to access loans several times the value of their savings. For example, if an individual's savings amount to Ksh1,000, they may qualify for an asset loan of up to Ksh5,000, significantly expanding their purchasing power and enabling them to acquire more substantial household items.

“Asset loans are not just about acquiring household items; they’re about providing a pathway to dignity, empowerment, and a better quality of life for those in need.”

Conclusion:

Asset loans provided by Deep Heart Ltd offer a viable solution for individuals seeking to purchase essential household items but facing financial constraints. By leveraging valuable assets as collateral, borrowers can access the funds they need without the barriers typically associated with traditional lending channels. As a result, asset loans contribute to financial inclusion, poverty alleviation, and overall community development. For individuals and families striving to build a better future, these loans represent not just a means to acquire household goods but also a pathway to greater economic opportunity and empowerment.